All Categories

Featured

Table of Contents

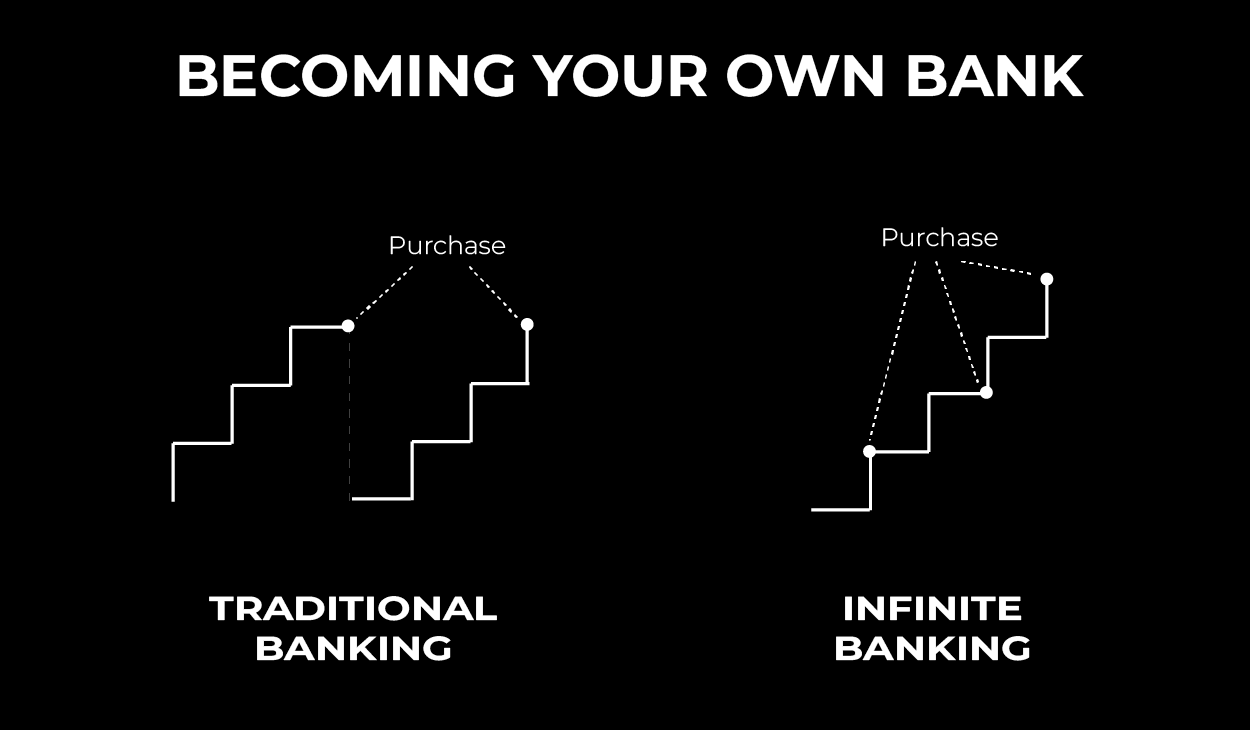

The method has its very own benefits, but it likewise has concerns with high fees, complexity, and a lot more, leading to it being considered a fraud by some. Infinite financial is not the most effective policy if you require just the investment part. The infinite banking principle rotates around making use of entire life insurance policies as a financial device.

A PUAR enables you to "overfund" your insurance policy right as much as line of it coming to be a Changed Endowment Agreement (MEC). When you make use of a PUAR, you rapidly increase your cash value (and your death advantage), thus increasing the power of your "bank". Additionally, the even more cash money worth you have, the greater your passion and reward settlements from your insurer will be.

With the surge of TikTok as an information-sharing platform, economic recommendations and techniques have found an unique means of spreading. One such technique that has been making the rounds is the unlimited financial principle, or IBC for short, garnering recommendations from celebrities like rapper Waka Flocka Fire - Borrowing against cash value. However, while the technique is currently prominent, its origins trace back to the 1980s when economist Nelson Nash presented it to the world.

What resources do I need to succeed with Financial Leverage With Infinite Banking?

Within these plans, the money worth grows based on a rate set by the insurance firm. When a considerable cash money worth collects, insurance policy holders can acquire a cash worth finance. These lendings vary from conventional ones, with life insurance policy functioning as collateral, meaning one can shed their protection if loaning excessively without appropriate money value to sustain the insurance policy prices.

And while the allure of these policies is apparent, there are natural constraints and dangers, demanding diligent cash money value monitoring. The approach's legitimacy isn't black and white. For high-net-worth individuals or company owner, especially those using methods like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and compound growth might be appealing.

The allure of infinite financial does not negate its obstacles: Cost: The foundational requirement, a long-term life insurance policy plan, is more expensive than its term counterparts. Eligibility: Not everyone gets approved for entire life insurance policy because of strenuous underwriting procedures that can omit those with details health or way of living problems. Complexity and risk: The detailed nature of IBC, combined with its dangers, might prevent lots of, specifically when less complex and much less high-risk alternatives are available.

How do I qualify for Wealth Building With Infinite Banking?

Allocating around 10% of your month-to-month income to the plan is simply not viable for a lot of individuals. Component of what you review below is merely a reiteration of what has already been stated over.

So before you obtain into a situation you're not gotten ready for, recognize the following first: Although the idea is typically offered as such, you're not in fact taking a finance from on your own. If that were the situation, you wouldn't have to settle it. Rather, you're obtaining from the insurance policy business and need to settle it with interest.

Some social networks posts suggest using cash value from whole life insurance to pay for credit card financial debt. The idea is that when you pay back the finance with passion, the quantity will certainly be sent out back to your investments. That's not exactly how it functions. When you pay back the financing, a portion of that rate of interest goes to the insurance company.

What makes Leverage Life Insurance different from other wealth strategies?

For the first numerous years, you'll be paying off the compensation. This makes it very difficult for your plan to gather worth throughout this time. Unless you can manage to pay a few to a number of hundred bucks for the following years or more, IBC won't work for you.

Not every person should count only on themselves for financial security. Infinite Banking cash flow. If you require life insurance policy, here are some important ideas to take into consideration: Think about term life insurance. These policies provide protection throughout years with considerable financial obligations, like home loans, trainee car loans, or when taking care of kids. Ensure to look around for the ideal price.

How does Bank On Yourself create financial independence?

Visualize never ever having to worry concerning financial institution fundings or high interest rates once again. That's the power of unlimited financial life insurance coverage.

There's no set lending term, and you have the freedom to decide on the payment schedule, which can be as leisurely as repaying the funding at the time of death. This versatility reaches the servicing of the finances, where you can select interest-only repayments, maintaining the funding balance level and manageable.

How do I track my growth with Infinite Banking Benefits?

Holding cash in an IUL repaired account being attributed interest can typically be far better than holding the cash money on deposit at a bank.: You've always imagined opening your own bakery. You can obtain from your IUL policy to cover the first expenses of renting out a space, acquiring tools, and working with team.

Individual car loans can be obtained from typical banks and credit unions. Borrowing cash on a credit rating card is typically really pricey with annual percent prices of rate of interest (APR) commonly reaching 20% to 30% or even more a year.

Latest Posts

Be Your Own Bank With The Infinite Banking Concept

Using Your Life Insurance As A Bank

Byob: How To Be Your Own Bank