All Categories

Featured

Table of Contents

The method has its own benefits, however it likewise has problems with high charges, complexity, and extra, resulting in it being considered a fraud by some. Boundless banking is not the most effective plan if you require just the investment element. The infinite financial principle focuses on the usage of whole life insurance plans as a monetary device.

A PUAR permits you to "overfund" your insurance coverage right up to line of it ending up being a Changed Endowment Contract (MEC). When you use a PUAR, you quickly enhance your cash money value (and your fatality benefit), therefore enhancing the power of your "bank". Even more, the more money worth you have, the higher your rate of interest and reward payments from your insurer will be.

With the surge of TikTok as an information-sharing platform, monetary advice and techniques have actually located a novel method of dispersing. One such technique that has been making the rounds is the unlimited financial principle, or IBC for brief, amassing endorsements from celebs like rap artist Waka Flocka Flame - Infinite Banking account setup. However, while the approach is presently popular, its origins map back to the 1980s when economist Nelson Nash presented it to the world.

Infinite Banking Wealth Strategy

Within these policies, the money value grows based on a price set by the insurance company. Once a significant cash value collects, insurance holders can obtain a money value financing. These lendings differ from conventional ones, with life insurance policy serving as security, indicating one can shed their protection if loaning exceedingly without adequate money value to support the insurance policy prices.

And while the appeal of these policies appears, there are inherent limitations and threats, necessitating attentive money worth monitoring. The method's authenticity isn't black and white. For high-net-worth people or entrepreneur, specifically those making use of methods like company-owned life insurance coverage (COLI), the benefits of tax breaks and substance development can be appealing.

The attraction of limitless financial doesn't negate its obstacles: Price: The fundamental need, a long-term life insurance policy plan, is pricier than its term equivalents. Eligibility: Not everybody gets approved for entire life insurance coverage due to strenuous underwriting processes that can omit those with certain health or lifestyle problems. Complexity and threat: The detailed nature of IBC, paired with its threats, might deter many, especially when less complex and much less high-risk choices are available.

What is the best way to integrate Infinite Banking Account Setup into my retirement strategy?

Designating around 10% of your regular monthly earnings to the plan is just not viable for lots of people. Utilizing life insurance policy as an investment and liquidity source requires self-control and tracking of plan cash value. Consult a monetary advisor to identify if limitless banking straightens with your priorities. Component of what you check out below is simply a reiteration of what has actually already been stated over.

Prior to you get on your own right into a circumstance you're not prepared for, recognize the adhering to first: Although the concept is frequently sold as such, you're not really taking a funding from yourself. If that were the situation, you would not have to settle it. Instead, you're obtaining from the insurer and need to repay it with passion.

Some social media blog posts recommend making use of money worth from whole life insurance policy to pay down credit rating card debt. When you pay back the finance, a section of that rate of interest goes to the insurance policy company.

How do I track my growth with Infinite Banking Concept?

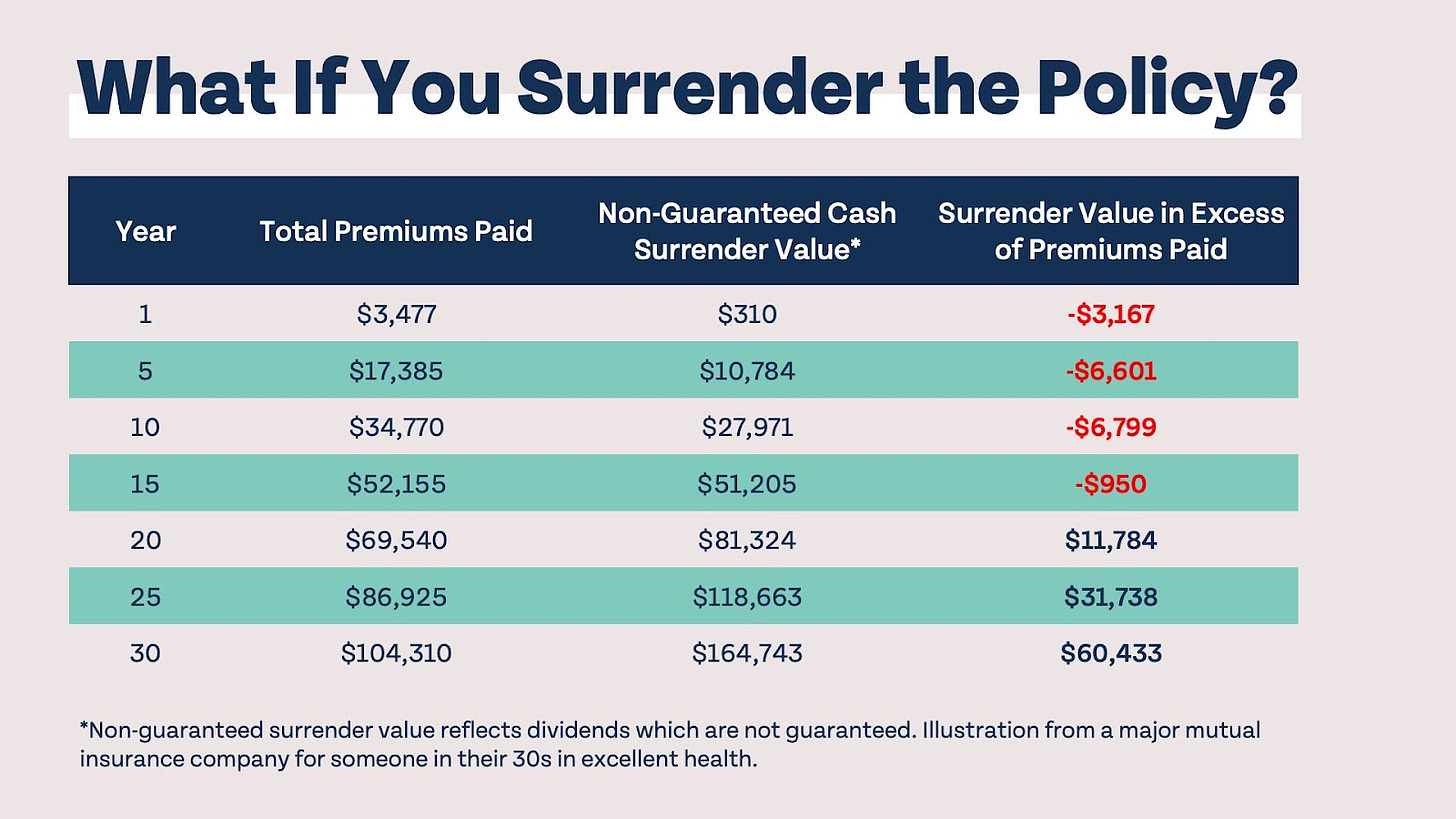

For the very first several years, you'll be paying off the compensation. This makes it exceptionally hard for your policy to build up value throughout this time. Unless you can pay for to pay a few to a number of hundred bucks for the next decade or more, IBC won't work for you.

Not everybody ought to count solely on themselves for economic safety. Private banking strategies. If you call for life insurance policy, below are some valuable tips to think about: Think about term life insurance coverage. These plans offer insurance coverage during years with substantial financial commitments, like mortgages, student lendings, or when caring for little ones. Ensure to search for the finest price.

How secure is my money with Infinite Banking For Financial Freedom?

Visualize never ever having to stress over bank lendings or high interest rates once more. Suppose you could obtain cash on your terms and develop wealth at the same time? That's the power of unlimited financial life insurance policy. By leveraging the cash money worth of whole life insurance policy IUL plans, you can grow your riches and borrow cash without depending on traditional financial institutions.

There's no set lending term, and you have the flexibility to choose the repayment schedule, which can be as leisurely as settling the financing at the time of death. This versatility extends to the servicing of the fundings, where you can decide for interest-only payments, maintaining the finance balance flat and convenient.

What is the minimum commitment for Privatized Banking System?

Holding cash in an IUL dealt with account being credited passion can commonly be much better than holding the money on deposit at a bank.: You have actually always desired for opening your very own pastry shop. You can borrow from your IUL plan to cover the initial costs of renting out a room, acquiring tools, and hiring personnel.

Individual loans can be acquired from conventional financial institutions and lending institution. Right here are some vital factors to consider. Charge card can give a versatile means to obtain cash for extremely short-term periods. Borrowing cash on a credit card is typically extremely costly with yearly portion prices of passion (APR) typically getting to 20% to 30% or more a year.

Latest Posts

Be Your Own Bank With The Infinite Banking Concept

Using Your Life Insurance As A Bank

Byob: How To Be Your Own Bank